Crypto Tears- why your crpto friends crying

Crypto Armageddon, Crypto 2008, judgement day… and many more are some of the words being used to describe what is currently going on in the crypto world right now. A time of gnashing of teeth, pain, difficult realisation and an awful sinking feeling in the stomach of investors watching their net worth and life savings crumble. Why is this happening in case you’re not familiar with the crypto space, why have you been hearing of FTX a lot more lately?

What is going on?

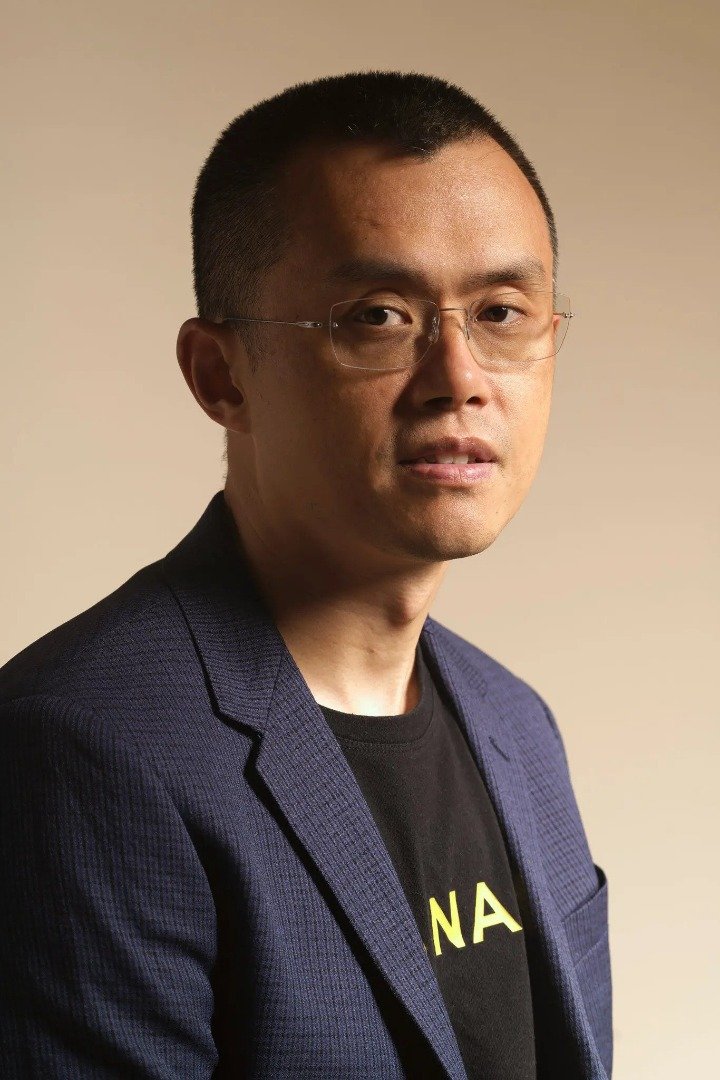

First off, we need to understand the primary reason for the turmoil; the FTX crash. What is FTX? According to Investopedia FTX Exchange is a leading centralized cryptocurrency exchange specializing in derivatives and leveraged products. Well, “was” is the right verb tense now. Founded in 2018 by MIT graduate and former Jane Street Capital international exchange-traded funds trader Sam Bankman-Fried, FTX was the number 2 biggest cryptocurrency exchange in the world, only behind Binance. And that is where this story got its tag “Crypto Armageddon”. To be frankly clear, CEOs of both exchanges have been known to publicly not like each other, with both of them justling over being the best and most popular. Quite ironic given that cryptocurrency is supposed to be a decentralised space, two huge central powers bickering should have been a red flag.

Now let’s talk about FTX and its founder because even though the initial chips in the fall were tipped by corporate deceit, the bulk of the blame still lands in the hands of FTX founder, Sam Bankman-Fried. On November 2, the crypto magazine CoinDesk reported on a leaked document that claimed to reveal that Alameda Research, a hedge fund controlled by Mr Bankman-Fried, possessed an abnormally significant quantity of FTT tokens. This occurrence started the following days of panic and bad news that seems to get worse with each passing day and the break of yet another bad secret. Why is Alameda holding FTT tokens a bad thing for Bankman-Fried and his institution? Although FTX and Alameda are intended to be different firms, the investigation alleged that they had strong financial relationships. Alameda is set up to be an investment sector, a high-risk organisation and so FTX investors finding out that their once trusted CEO was gambling with their money more so after he said he wasn’t, was catastrophic for trust. In the financial sector, trust is everything and fear is death.

Binance announced on Nov. 6 that it would sell its FTT tokens “due to recent revelations.” In response, FTT’s price plummeted and traders rushed to pull out of FTX, fearful that it would be yet another fallen crypto company just like Luna a few months before. FTX hurried to execute withdrawal requests totalling an estimated $6 billion over three days. It appeared to be in a liquidity crisis, which meant it lacked the funds to fulfil demands. The problem was then made sadly evident, FTX had its money, investors’ money, all in liabilities and FTT tokens which the latter was becoming increasingly worthless as the price plunged in the massive withdrawals. FTX simply couldn’t pay people anymore.

In this mire, Binance CEO announced on his Twitter account that FTX had reached out for help (a condition that for many people was an indicator of how bad things were for FTX) and Binance were in talks to bail out FTX. However, in a move that totally pushed FTX off the proverbial edge, Binance pulled out of the deal and on the 11th of November FTX filed for bankruptcy. In its bankruptcy petition, FTX Trading said it has $10 billion to $50 billion in assets,

$10 billion to $50 billion in liabilities, and more than 100,000 creditors. The situation was dire, traders had panicked and rushed to withdraw $6 billion from the platform in just 72 hours.

Millions of people have been affected, not just only investors who have funds in FTX but also other spheres in the crypto world as the failure of the second largest crypto exchanges in the world had badly affected the prices of cryptocurrencies. Bitcoin, Ethereum, and many others were harmed as so virtually everyone in the space right now has been negatively affected by this crash. While some have pointed to this not being a surprise, pointing to the known volatility of crypto and even the frequent gaffes from Backman-Fried (he once mistakenly referred to exchanges as a Ponzi scheme) as reasons why people should have been more careful, a lot of people trusted and invested millions in the company, thinking their investments safe in a sure foundation of an industry preached to be here to stay.

Why blame Binance?

It is rumoured that Binance in a bid to get back at Backman-Fried for a perceived malicious tweet he put out, helped Coindesk with the information which got leaked and spelt the downfall of FTX. Selling off their FTT holdings was the major selling force that caused the massive withdrawals by traders. Also, the game of rescue and pullout played by Binance while in truth might not have had any effect on FTX itself as the company was already on its knees, showed once again an active involvement by Binance. Binance had said that it had achieved an agreement to buy FTX to save it. However, Mr Zhao stated in the statement that “Binance retains the right to withdraw from the arrangement at any moment.” He did.

What now?

At least $1 billion in client funds have vanished from the FTX platform as a result of the instability. While investors and traders felt the deed was done and it was now time to count losses and begin the long journey of recovery, news broke out on 12 December that the exchange had been hacked and $600 million transferred out. This news has enraged people as it seems like the people who caused so much heartbreak and loss are trying to get away with it without any consequence. Currently, according to Bloomberg Billionaire Index, Sam Bankman-Fried’s net worth fell from $16 billion to $0 in just days. It is indeed a sad and utterly shocking development which seems to grow another branch with each passing day.

12 comments

Your article helped me a lot, is there any more related content? Thanks!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

I truly appreciate your technique of writing a blog. I added it to my bookmark site list and will

Good post! We will be linking to this particularly great post on our site. Keep up the great writing

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Because the admin of this site is working, no uncertainty very quickly it will be famous, due to its quality contents.

I simply could not depart your website prior to suggesting that I really enjoyed the

standard information an individual provide

on your guests? Is going to be again continuously in order to check up

on new posts

Also visit my blog post – av 女優

I simply could not depart your website prior to suggesting that I really enjoyed the

standard information an individual provide

on your guests? Is going to be again continuously in order to check up

on new posts

Also visit my blog post – av 女優

I am really inspired along with your writing abilities and also with the format in your weblog. Is this a paid subject or did you customize it yourself? Either way stay up the excellent quality writing, it’s uncommon to see a nice blog like this one these days..

I’m impressed, I must say. Rarely do I come across a blog that’s equally educative and interesting, and let me tell you, you’ve hit the nail on the head. The issue is something that not enough folks are speaking intelligently about. I am very happy I found this in my hunt for something regarding this.